Stock prices up more than 10% since shutdown began

Four weeks into a partial government shutdown that has gnarled air travel, threatened millions of tax refunds and stalled environmental protections, Wall Street seems to have a message for the feds: Stay shut.

Major U.S. stock indexes are up more than 12 percent since Dec. 24, the first day of the shutdown that markets were open.

News that the U.S. and China were considering dropping trade barriers sent the major market indexes even higher Friday afternoon, but stocks have been rising since the shutdown began. The S&P 500-stock index, now up for four weeks straight, was trading at 2,667 at 11:30 a.m. Eastern time on Friday, and was up 2.3 percent this week. The blue-chip Dow Jones industrial average was trading at 24,616, a spike of 3.2 percent since Monday, while the tech-heavy Nasdaq composite rose 3.9 percent this week to 7,164.

Apparent progress in U.S.-China trade talks, as well as limited economic data coming out that shows the U.S. economy remains on solid footing, seem to have persuaded investors the economy isn’t turning south, as have assurances from Federal Reserve Chair Jay Powell that the central bank would be “patient” and listen to the markets.

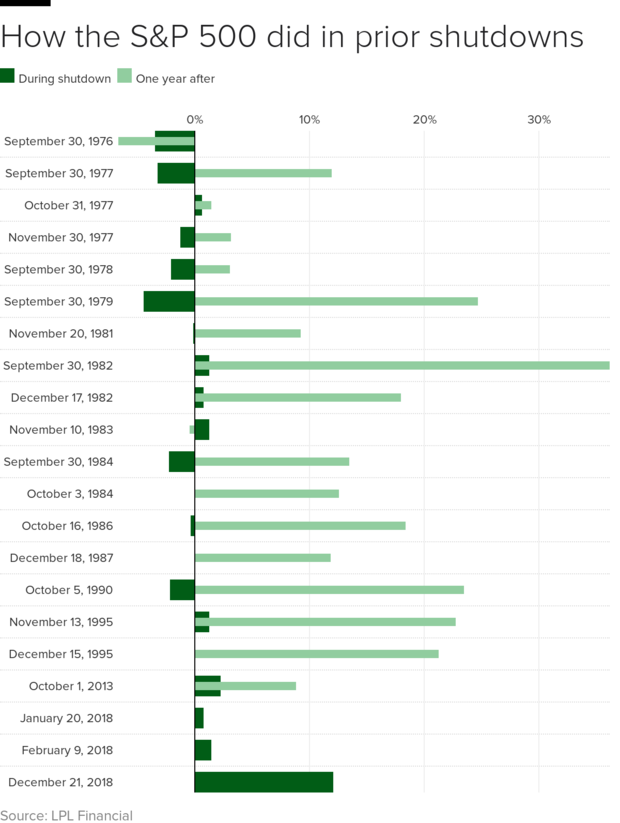

“Past shutdowns have largely been a nonevent for the U.S. economy and stocks. Business and consumer confidence indicators usually decline and government spending drops during a shutdown, but any losses have typically been recouped quickly,” John Lynch, research chief investment strategist at LPL Financial, said in a blog post.

Still, the S&P 500 has typically fallen in previous shutdowns, according to LPL. The fact that stocks are now rising makes the current shutdown unusual for more than its length. On average, the index drops by 0.4 percent in shutdowns, LPL found. Before the current shutdown, the biggest stock rise occurred during the shutdown of 2013. During the 17 days the federal government was closed, the S&P 500 rose 2.3 percent.

It’s worth remembering that stocks have been unusually volatile in the past half-year, and can turn on a dime. The current shutdown has also depressed consumer spending, and economists predict it could reduce GDP growth for the first quarter by as much as 0.3 percent.

Indeed, New York Federal Reserve President John Williams on Friday said he was “seeing some emerging headwinds to growth from the partial government shutdown.”

Investors will have to wait a while for the shutdown’s impact to be measured—the government agency that tracks the GDP is included in in the shutdown.

Leave a Reply